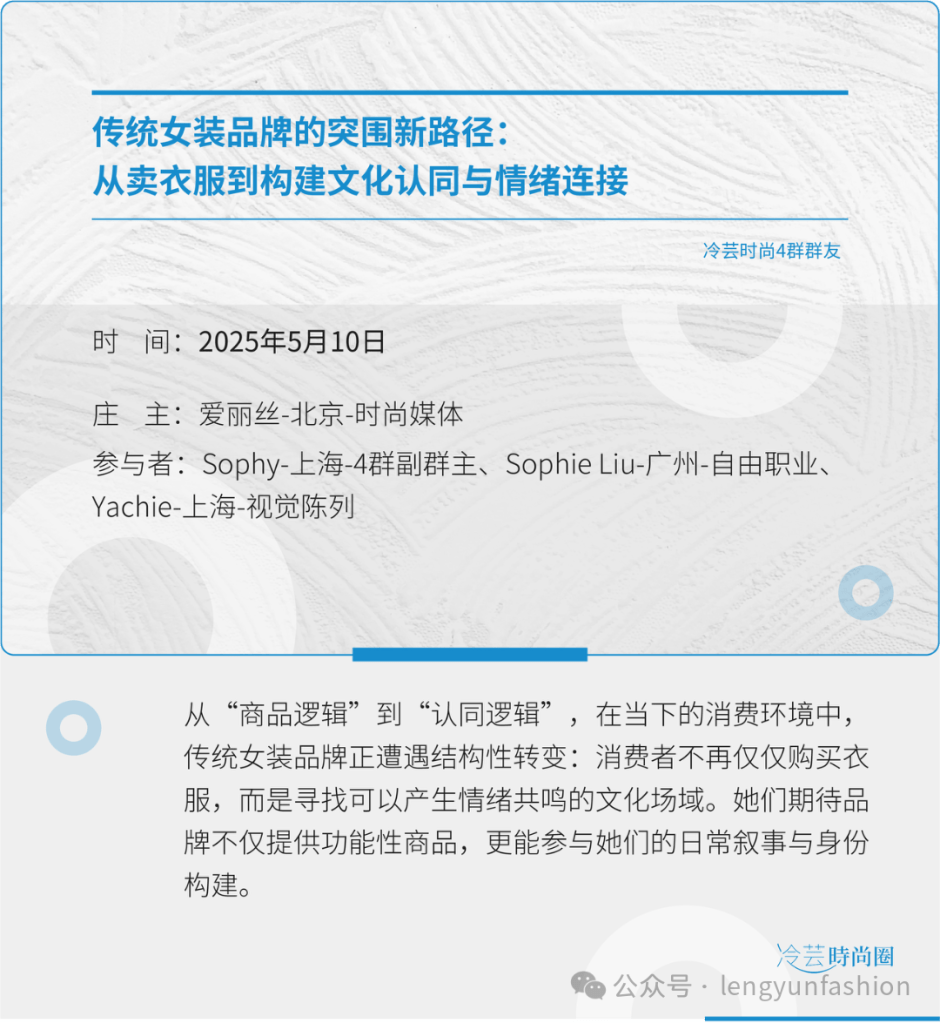

▼The following discussions from the Cold Fashion Circle are based on industry issues. These insights represent the collective wisdom of professionals in the field and are not necessarily the personal views of the Cold Fashion team. Our goal is to provide industry professionals with valuable information and practical insights.

1. Why are contemporary consumers no longer satisfied with “buying a piece of clothing”?

Why do I want to discuss this topic today? As a women’s wear designer and brand professional,

I’ve observed that traditional business models for clothing brands struggle to survive in today’s society. We are now in an era of “emotional awakening” among consumers.

Previously, buying clothes was about practicality, aesthetics, and trends. But now, more consumers prioritize:

“Does wearing this piece express who I am?”

“Do I resonate with this brand’s values?” In other words, we’ve shifted from a “product logic” to an “identity logic”—clothing is no longer just worn; it’s a form of cultural expression and emotional projection. Today, we’ll explore this shift’s implications for brands from three angles:

Contemporary fashion brands can no longer rely solely on selling apparel. They must transform across multiple dimensions to meet modern demands. This shift is evident across brands of all tiers, from luxury houses to street-side boutiques, all exploring new operational models.

LVMH’s strategic transformation offers a prime example. By acquiring brands like BELMOND (specializing in luxury train travel and heritage hotels), LVMH has integrated traditional travel services into its “luxury lifestyle experience” ecosystem. This move shows brands are no longer confined to offering products but are curating “a world you can live in.” Integrating assets like the Venice Simplon-Orient-Express and Machu Picchu Belmond demonstrates a brand universe built around “temporality, aesthetics, and travel philosophy.”

2.Brands Cultivating Holistic Experiential-Cultural Propositions

In experiential marketing, JACQUEMUS pioneered a unique market model. The brand created pop-up “LES MARCHÉS DE JACQUEMUS” in French villages and urban corners, selling produce, flowers, and daily goods from Southern France to recreate the brand’s local market culture. These markets aren’t primarily for selling clothes but for delivering sensory and emotional experiences, immersing consumers in JACQUEMUS’s romantic Southern French world and reinforcing its “life as style” ethos.

Chinese domestic brands are innovating culturally too. For example, MUKZIN’s “Female Heroes Series” reinterpreted Chinese knight-errant culture, showcasing local creative expression. This trend is prominent on LINK FASHION’s livestreams, where many domestic brands are deeply exploring Chinese cultural elements.

Traditional women’s wear brands are also transforming. Brands now develop seasonal narratives and concepts from the R&D stage, promoting them holistically via stores, e-shops, and digital media. Livestreaming has become vital—even small street shops now integrate masks, patches, bedding, and curated foods.

3. Case Analysis

Ambassador strategies reflect brands’ market acuity. While others still used post-85-born celebrities, MIU MIU prioritized Gen-Z (post-00s). This differentiated choice highlights its pursuit of youthful energy while embracing multi-generational consumers.

Yet, innovative marketing faces hurdles in China. BOTTEGA VENETA was widely mocked on Xiaohongshu for a crude installation deemed an “IQ tax.” BALENCIAGA’s avant-garde stunts and ALEXANDER WANG’s elderly Taobao model campaign sparked buzz but faced skepticism. Such Western avant-garde strategies often misfire in China.

BV’s “not catering to the masses” philosophy particularly stumbled. Critics felt its minimalism paled against competitors’ polished displays, failing Chinese consumers’ expectations for substance.

1. How Social Media Became Brands’ “Daily Narrative Space”

For China’s fashion players, choosing marketing strategies is critical. Should they embrace avant-garde creativity or prioritize localization? Foreign brands’ misfires suggest domestic brands must deeply understand local aesthetics and values.

Modern branding hinges on lasting connections—shifting from “seller” to lifestyle “curator.” Especially in women’s wear, building “emotional communities” is vital. Brands must make consumers feel wearing their products means “living as your ideal self.” This requires cultural output and emotional resonance beyond sales.

Cross-cultural marketing often stumbles. BURBERRY’s gloomy Chinese New Year ads clashed with festive joy, sparking backlash. This highlights the gap between Western brands’ understanding and local expectations.

Still, some brands are localizing deeper. BOTTEGA VENETA enlisted Fan Wei and Yu Xiuhua as ambassadors to authentically connect with Chinese culture—though its impact remains unproven.

2. Podcasts, Short Videos & Community-Based Private Domain Operations Centered on User Emotions

Social media is now a core survival structure—not just a tool. Fragmented consumption demands more than posters or launches. Xiaohongshu’s authentic shares, Douyin’s styling videos, and Weibo’s copywriting collectively build a brand’s “presence” and “warmth.”

A brand’s ability to sustain “lived-in fashion” on social media is now competitive. In China, Xiaohongshu and Douyin are essential. Users prefer KOL content over official accounts for its authenticity and utility.

Omni-channel marketing dominates China. Beyond social platforms, podcasts are rising. Luxury brands like L’Oréal and Loewe launch podcasts exploring culture beyond products. GIADA’s “In Bloom” podcast gained acclaim and attracted clients, deepening connections.

Marketing extends to physical spaces. GIADA opened Michelin-starred GIADA GARDEN in Beijing, serving Italian cuisine, and launched GIADA ACADEMY for cultural events. Such crossovers enrich brand culture and enable multi-dimensional engagement.

1. Early Applications: AI Boosts “Efficiency” & “Data Insights” in Fashion

Integrated multi-channel strategies let brands connect widely across scenarios. Podcasts, though niche, deliver brand narratives during commutes or chores. Despite slow monetization, brands invest, valuing cultural capital.

Yet, balancing platform fit, audience targeting, scale, and authenticity is key. Authentic, structured content—whether Xiaohongshu posts or Douyin clips—resonates best.

Fashion media and KOLs remain crucial. Brands’ sustained soft-marketing budgets confirm KOL endorsements dominate China. Third-party perspectives build credibility.

DIOR’s podcast invites artists, activists, and photographers to discuss female empowerment and art-fashion ties. This deepens cultural substance, creating a new “ear-centric” narrative space beyond Instagram/TikTok.

-SKIMS & KIM KARDASHIAN’s Private Community Operations

Beyond TikTok/Instagram, SKIMS engages fans via Kim’s private exposure, email marketing, and emotional topics (e.g., “Best PMS Outfit”). Its strategy: make fans feel “this brand gets me,” not just “love the product.”

-MAISON KITSUNÉ’s Community-Lifestyle Approach

French niche brand KITSUNÉ sells clothes, runs cafés, hosts raves, and operates a music label. This “immersive community development” positions it as a “cultural curator,” not just a clothier.

Podcasts show unique value. GIADA’s podcast features intellectuals like Dong Qing and Lu Yu, aligning with its positioning and attracting target clients. Many guests are clients themselves, fostering a cultural community.

2. New Trend: AI as a Cultural-Emotional Tool

However, many Chinese brands prioritize short-term monetization (e.g., livestreaming) over cultural capital. TIMBERLAND offers an alternative: During tough times in China, lead Olga spent 10 months crafting an ad that doubled sales upon release. Cultural content, though “slow,” enables healthier growth.

Deep content is trending—greater depth drives higher engagement. Demand for quality persists, e.g., Dong Jie’s anti-hardsell livestream success proves deep content has a stable audience.

AI unlocks innovation: From BALENCIAGA’s virtual try-on to future mood-sensing accessories (e.g., color-shifting rings, content-pushing earphones, weather/mood-responsive fabrics). This is no longer sci-fi.

3. Discussion: Can AI-Fashion Fusion Create a New Category—Smart Emotional Accessories That Express Style and Inner States?

China’s market demands agility. Unlike France, store ownership can change in months. This volatility reflects operational challenges and a lack of long-term branding.

Monetization obsession is rampant. Platforms exploit “small-task” incentives, leveraging petty gains psychology. Such tactics yield short-term results but damage long-term branding—unlike less consumerist Western social media.

Culturally-driven brands face unique pressures. On Pinduoduo, identical items sell at rock-bottom prices with free shipping/returns, attracting value seekers. Some Taobao shops sell long sunscreen coats for ¥8.4—raising quality/sustainability concerns.

Amid economic headwinds and rising unemployment, sustaining premium brand culture via apparel sales alone is harder. Brands must expand via cultural merchandise, reflecting broader societal constraints on sustainable consumption.

Ultimately, authentic storytelling is core. From luxury houses to street shops, all seek to understand and serve consumers better. Emotional value, cultural depth, and authenticity become priceless assets—balancing innovation with brand essence is key.

Leave a comment