▼The following discussion in Leng Yun fashion community is a discussion and summary of industry issues. These shares are the crystallisation of collective wisdom. (They do not represent the personal views of Leng Yun). It is hoped that this method will benefit more industry professionals!

1. Policy Environment

The current policy environment for the ice and snow economy is quite favorable. The latest China Ice and Snow Industry Development Research Report (2024), released by the General Administration of Sport of China, shows that the ice and snow industry reached a scale of RMB 970 billion in 2024. From November 1, 2024, to February 4, 2025, the skiing population continued to grow, with 934 ski resorts across 31 provinces (autonomous regions and municipalities) receiving a total of 151 million visitors, a year-on-year increase of 27.8%. During the Spring Festival, ski resort visits nationwide increased by 10% year-on-year, with Heilongjiang recording a 13.5% growth in ski visitors.

Indeed, Heilongjiang’s winter tourism experienced an explosive boom. On November 6, 2024, the General Office of the State Council issued the Several Opinions on Stimulating the Vitality of the Ice and Snow Economy through High-Quality Development of Ice and Snow Sports. This important document outlined two key milestones for the ice and snow economy:

By 2027, venues and services will be largely improved, public participation in ice and snow sports will be enhanced, competitiveness in international winter sports events will be strengthened, and the overall scale of the ice and snow economy will reach RMB 1.2 trillion.

By 2030, the ice and snow economy will play a significant role in expanding employment and promoting high-quality development, becoming an important driver of domestic demand, reaching RMB 1.5 trillion.

This document aims to consolidate and expand the achievement of “engaging 300 million people in ice and snow sports,” leveraging sports to drive the development of ice and snow culture, equipment, tourism, and the entire industry chain, thereby positioning the ice and snow economy as a new growth engine. From a policy perspective, demand for the ice and snow economy is expected to remain strong.

2. Market Overview

In recent years, promotional content on platforms such as Douyin frequently featured tourism in Northeast China. Destinations like Changbai Mountain and Harbin were widely promoted for their snow scenery, Ice and Snow World, ice lanterns, and snow sculptures. Viral topics, such as the “frozen yellow rose,” further boosted popularity. The ice and snow economy has also been expanding beyond Northeast China to southern regions.

For example, Anji in Zhejiang has become a popular skiing destination for young people from Jiangsu, Zhejiang, and Shanghai. Ski resorts near Beijing have also seen strong demand. In November last year, Shanghai’s YaoXue Ice and Snow World opened, reportedly the largest indoor ski resort in Asia, drawing attention as a new “check-in” destination. Other places, such as Yunshang Grassland, have also attracted visitors.

Even in tropical regions like Guangzhou and Shenzhen, large indoor ski resorts have been built, surprising many. Guangzhou, in particular, hosts a sizable indoor ski venue frequented by skilled skiers and families. However, similar facilities have not yet appeared in Yiwu.

This boom can be attributed to the Winter Olympics and the influence of athlete Gu Ailing (Eileen Gu), whose popularity sparked enthusiasm for skiing. At the 2025 Harbin Asian Winter Games, the Chinese delegation won 32 gold, 27 silver, and 26 bronze medals, totaling 85. Since 2022–2023, public enthusiasm for skiing and related sports has significantly increased.

1. Consumer Segmentation

During this period, many luxury brands launched ski apparel collections. It was reported in a private group that a certain IT industry executive spends hundreds of thousands of RMB annually on ski equipment, flying to ski destinations every one to two weeks in winter. This highlights the strong purchasing power of wealthy individuals.

Dior’s ski apparel gained considerable attention. For instance, two years ago, a woman was spotted skiing in a pure white Dior ski suit—sleek and fashionable, in contrast to traditional ski wear.

Other notable brands include Moncler, Fendi, Louis Vuitton, Zegna, and EA7, all of which released ski apparel collections. Moncler, known for its down jackets, has long been active in the outdoor sportswear segment. Loro Piana, a traditional luxury brand associated with “old money,” has also entered the winter outdoor apparel market. With LV and Prada previously collaborating with Carhartt, it is likely that more fashion brands will integrate ski apparel elements, blending aesthetics and functionality to maximize market value.

Loro Piana, a traditional luxury brand associated with “old money,” has also entered the winter outdoor apparel market. With LV and Prada previously collaborating with Carhartt, it is likely that more fashion brands will integrate ski apparel elements, blending aesthetics and functionality to maximize market value.

Ski apparel requires technical performance, including warmth, waterproofing, and wind resistance. Products that combine strong technical functions with stylish designs are particularly attractive to consumers.

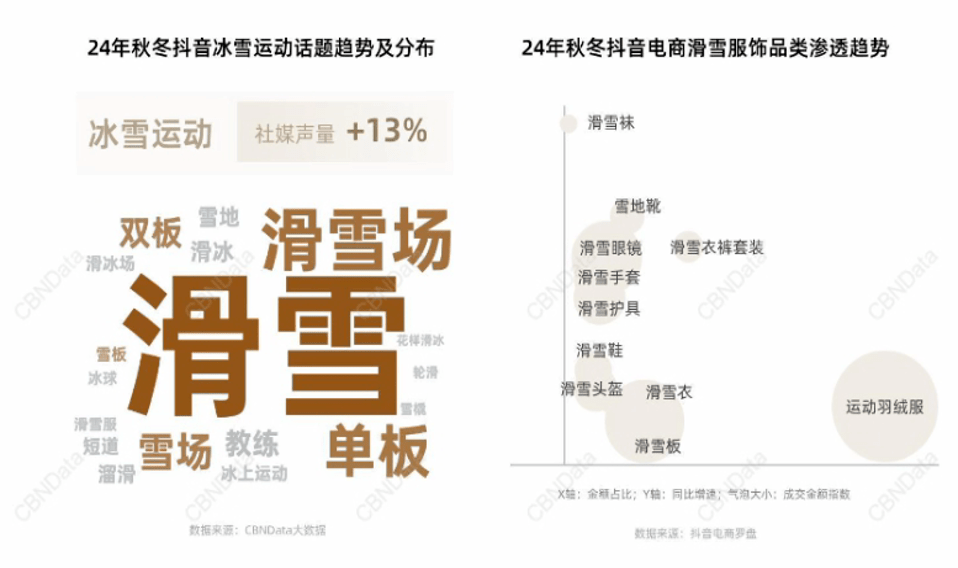

In recent years, many cities have opened ski resorts. According to a 2024 Douyin white paper, searches for skiing-related content ranked high, with snowboarding’s “trendy and photogenic” appeal especially popular. Ski-related social media discussions grew by 13%, and insulated down jackets achieved the highest transaction volumes.

2. Changing Consumer Trends

Does the ice and snow economy imply strong market demand? Products extend beyond ski apparel, covering venues, equipment, events, tourism, ticketing, and training.

Will ski apparel maintain long-term demand despite its limited use case? Some question whether ski apparel could become a fashion style like workwear.

Would it remain seasonal, or evolve into lightweight, commuter-friendly versions—similar to streamlined down jackets or tailored shell jackets? This potential signals opportunities.

Recent apparel trends favor versatile products suitable for daily wear. While outdoor and workwear styles are popular, ski apparel has fewer mainstream elements to translate. Ski goggles, however, have been adapted for hiking and other outdoor activities.

Some designs are less technical but versatile—removable snow skirts make them wearable for casual occasions, adding to their appeal. Such “fashionable down jackets” were popular in recent years.

Is ski apparel a short-lived trend or a lasting category? Some industry voices remain optimistic, citing workwear’s decades-long evolution. Ski apparel may similarly take time to solidify its place.

Domestic brand Songguo is a well-known ski apparel label, praised for stylish designs and affordable prices, with sets available for a few hundred RMB. Though its quality remains debated, its popularity on platforms like Taobao and Xiaohongshu is clear. Retailers like Descente have also leveraged visual merchandising, while influencers such as Qianyun Design and JINGWAI promote related products.

1. Cultural and Tourism Integration

Detachable outer shells are versatile, appealing to enthusiasts who enjoy skiing and hiking alike. These designs resemble insulated shell jackets, offering both functionality and fashion.

Domestic ski apparel brands often feature bright, eye-catching colors favored by snowboarders. While not suitable for speed skiing, their durability and visual appeal make them popular for social media content. At the same time, simpler designs sold by Uniqlo or Unica Home attract consumers preferring minimalism.

2. From Skiing to Tennis: A New Sports Consumption Trend

Many are curious about ski instructors’ salaries, though few have concrete knowledge. Some consumers actually prefer ice skating for its accessibility and flexibility, though it lacks skiing’s popularity.

Recently, both tennis and skiing have seen rising interest. Tennis, in particular, is gaining traction. Many people on social media are now training in tennis, sparking widespread curiosity. Brands such as Hugo Boss and Lululemon are emphasizing tennis collections in their stores.

Tennis, like golf, is considered an elite sport linked to the “old money” aesthetic. Seasonal lifestyles of “tennis in summer, skiing in winter” are increasingly common, though both sports remain expensive. In Yiwu, for example, tennis lessons cost RMB 300 per hour, plus RMB 80 for court rental.

Do people ski with family or friends? Mostly with friends, as older generations tend to show less interest. However, data suggests youth and family participation are rising. Jilin’s “Snow Ruyi” youth winter camps achieved a 35% repurchase rate, while Xinjiang ski resorts reported growth in family skiing and youth bringing their own gear.

Creative collaborations also offer potential—for example, ski apparel inspired by James Bond 007 themes, combining adventure and storytelling.

The market now spans from affordable domestic brands like Songguo, to luxury brands with ski collections, and even expanding to tennis. Skiing is no longer exclusive to professionals but has become part of middle-class lifestyles. The growth of youth and family markets highlights significant potential. With supportive policies, both professional-grade equipment and versatile apparel are poised for further development. The key challenge lies in balancing functionality with everyday fashion, carving a distinctive brand positioning.

The ice and snow economy also extends to the silver economy. Does this mean elderly skiing? That may be risky, but winter wellness activities like hot springs are highly popular. Many young people also purchase hot spring experiences for their parents. This creates a complete winter leisure chain: skiing followed by hot springs.

Other brand cases include Nobaday, which signed world champion Max Parrot as ambassador, gaining visibility at the Winter Olympics podium. LV’s ski gear also gained exposure, though actual sales likely remain limited. Influencers like ski director Zhang Shaobo showcased such luxury ski gear on Xiaohongshu.

Domestic down jacket brand Gaofan has also gained attention with its high-end “Black Gold” series, featuring proprietary heating technology and distinctive branding. Unlike ski apparel, Gaofan focuses on premium insulated outerwear. Brands like Edition also illustrate how fashion houses develop niche lines for differentiation.

Functional fabrics play a crucial role in ski apparel. Domestic suppliers such as Sandé are known for R&D capabilities, producing waterproof yet breathable wool-blend woven fabrics. However, these advanced fabrics are costly, priced at RMB 400–600 per meter, limiting their adoption to top-tier brands.

Most domestic consumers prefer affordable, versatile apparel. This aligns with broader “long-termism” trends, emphasizing value for money. Brands like Pelliot, originally focused on shell jackets, have also expanded into ski apparel, highlighting affordability and color options.

3. Evolution of Ski Apparel Styles and Consumer Preferences

Beyond functionality, ski apparel incorporates varied styles, including sweet, edgy, and futuristic. Bright “dopamine colors,” promoted on Xiaohongshu, resonate with young consumers seeking vibrant contrast against snowy landscapes.

Brands increasingly target women, offering tailored colors and designs. With social media amplifying personal image, bright and expressive styles gained traction, aligning with dopamine fashion trends.

Purchasing behavior varies: some prioritize fabrics and craftsmanship, others colors and seasonal tones (light blue, beige, lilac for spring/summer; earthy tones for autumn/winter).

Trends also show rising demand for more feminine silhouettes, such as waist-cinched designs. For instance, Moncler’s classic down jackets are known for fitted cuts. However, in some markets, consumers still prefer relaxed fits with elastic hems. Overall, shorter, looser styles remain more widely accepted, with long coats reserved for extreme cold.

Value-conscious shoppers often default to Uniqlo, praised for fabric quality and affordability. Collections like Uniqlo U and C occasionally offer standout outerwear pieces.

Ski resorts increasingly feature social spaces, leveraged by brands for experiential marketing. For example, Arc’teryx opened a ReBIRD Service Center at Songhua Lake Resort in Jilin, offering gear maintenance and a café. Similar strategies are used by Boss and Snow Peak, integrating lifestyle spaces into retail.

Retailers now commonly enhance stores with lounge seating and outdoor setups to increase dwell time. Bogner’s recent runway show exemplified immersive marketing, blending staging with Olympic-inspired elements.

From hot spring wellness to café culture, from technical fabrics to experiential marketing, the ice and snow economy continues to extend its value chain. Brands are innovating not only in products but also in experiences, aiming to build holistic lifestyle ecosystems. Whether through luxury crossovers or affordable local offerings, all players contribute to this trillion-yuan market’s growth. The rise of insulated down jackets as mainstream outerwear—and their role in the broader ice and snow economy—remains a key trend to watch.

PS:Translation is done by AI.

Leave a comment